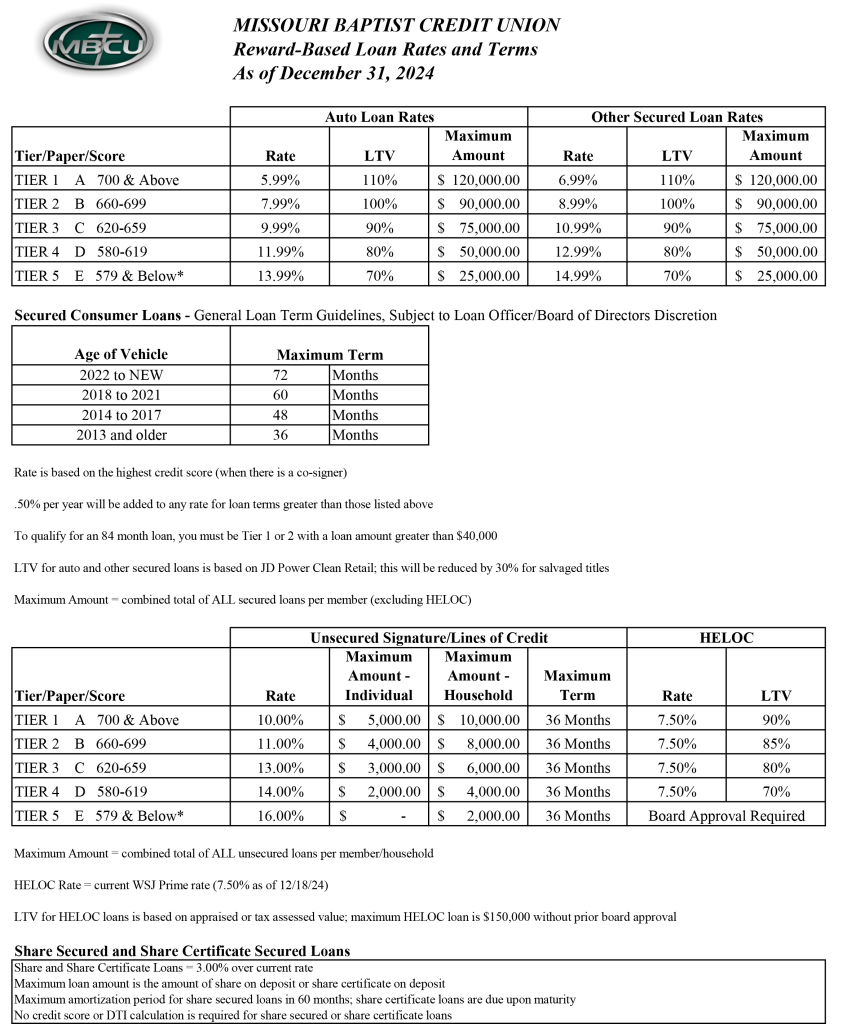

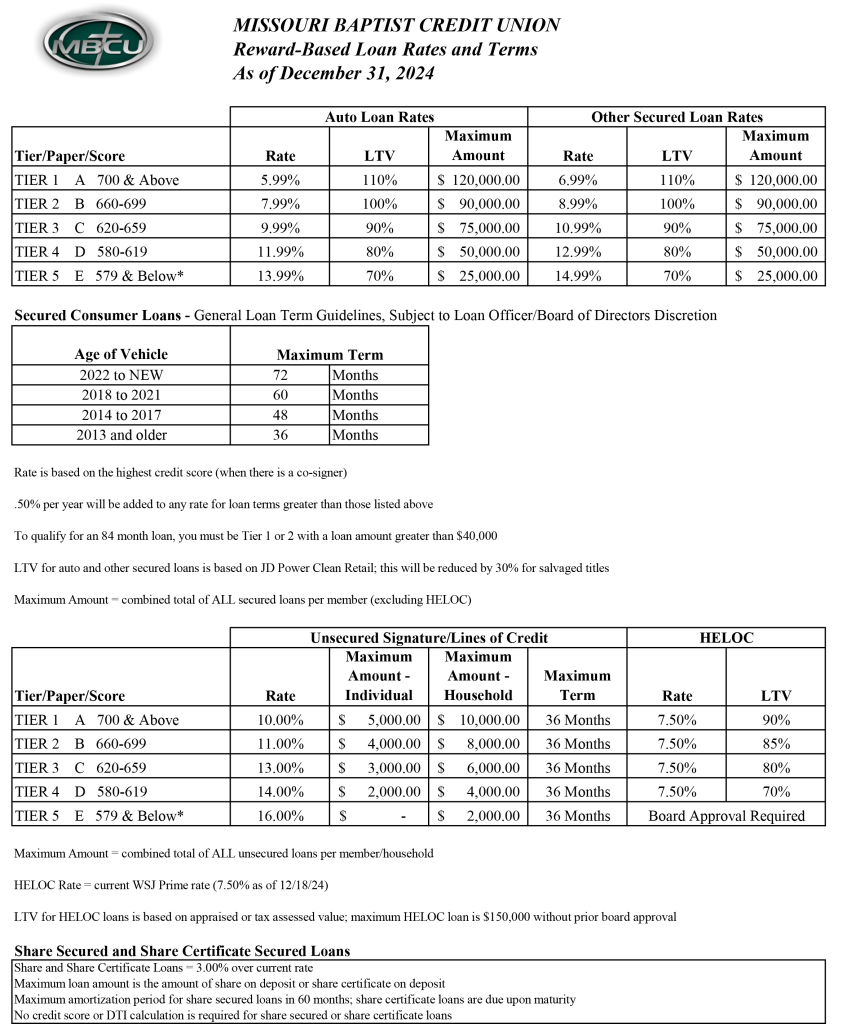

You can qualify for a loan today with the Missouri Baptist Credit Union, the trusted partner of Missouri Baptists.

R/T 286580894

Interested in joining the Missouri Baptist Credit Union? Have questions or feedback? We’d love to talk with you. Call 573-635-4428 or fill out the form below to get the conversation started.